Brand New Tax Cuts for the Super-Wealthy This Week

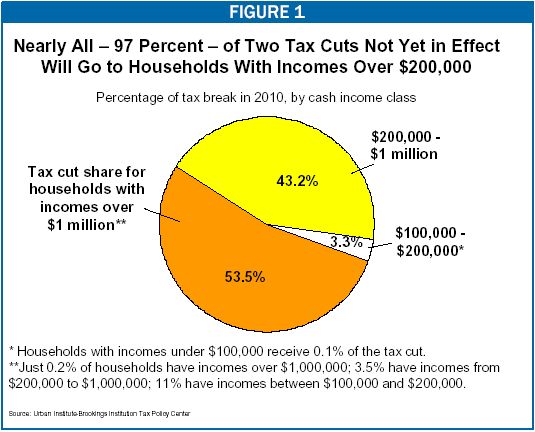

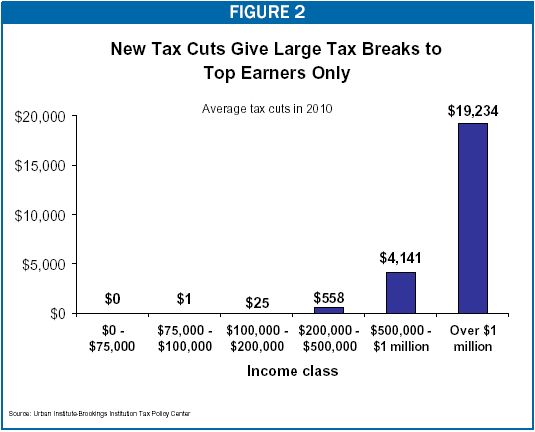

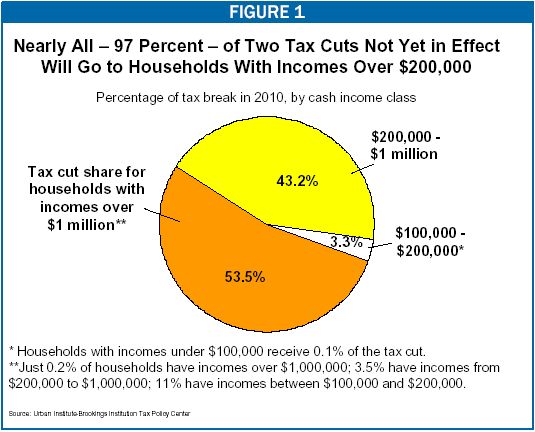

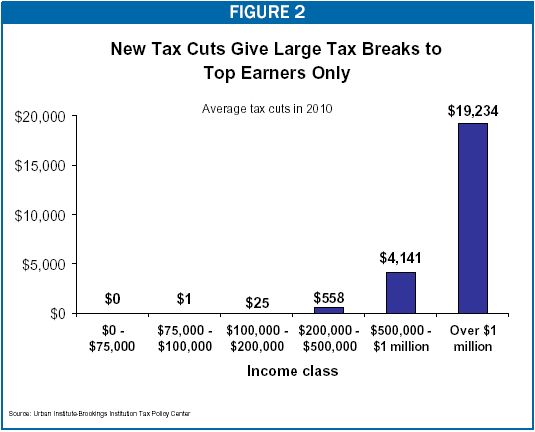

To very little MSM fanfare, two new tax cuts went into effect this week, and lo and behold they are even more unfair than the last cuts, only benefiting the super-wealthy. Check out these two charts based on Brookings analysis:

The previous tax cuts, while skewed to the wealthy, at least had very modest benefits for the upper middle class (with the real benefits increasing as you go up the income scale). These new cuts are like Republican tax policy in distilled form: Take from the poor and give to the rich.

The previous tax cuts, while skewed to the wealthy, at least had very modest benefits for the upper middle class (with the real benefits increasing as you go up the income scale). These new cuts are like Republican tax policy in distilled form: Take from the poor and give to the rich.

For a little background, if you have an extra 14 minutes, check out this video (6 items down) that explains more about how the "tax cuts" actually just shift the tax burden downwards.

Tags: economics, income disparity, Bush, Laffer Curve, taxes, tax policy, Congressional Budget Office, CBO, income disparity, Paul Krugman, tax cuts, news and politics

10 Comments:

At 10:21 AM, LL said…

LL said…

Balance it, sugar! I don't have time to drag out more recent stuff, but check here for 1999 info:

Tax Burden By Quintile

Notice how the lower fifth is in the negative. That is direct redistribution of wealth. If you held a gun to my head and made me give you a part of my take home pay, that would be robbery. But it is allowed, and in some circles encouraged, to do that via the government. I call bullshit.

At 12:43 PM, Solomon Grundy said…

Solomon Grundy said…

Hm OK, I looked at that site, but I don't think Bush is a libertarian, exactly.

My point is, Bush is only cutting taxes for the super-wealthy (above $200,000 income, with more than half of those cuts going to those who make over a million).

Bush should be honest about these tax cuts.

He should say (since this is his ACTUAL tax policy) "I believe that people who make over $1,000,000 are getting taxed too much, so I am going to drastically reduce taxes on the super-wealthy. However, I am going to raise taxes on those making between $33,000 and $86,000 a year. But that's only fair, because the super-wealthy have been paying more than their fair share."

If Bush were honest like that, I would at least respect his candor. I also doubt he would have gotten reelected. But at least he wouldn't have been a hypocrite.

Bush is not a reduce-taxes president. Bush is a reduce-taxes-for-the-wealthy-raise-taxes-for-the-lower-middle-class president.

At 1:03 PM, Antid Oto said…

Antid Oto said…

Notice how the lower fifth is in the negative. That is direct redistribution of wealth. If you held a gun to my head and made me give you a part of my take home pay, that would be robbery. But it is allowed, and in some circles encouraged, to do that via the government.

Actually, I think that pretty much counts as an indirect distribution of wealth. And if you believe that that use of public money is wrong, then you must believe that all taxation is inherently evil. I don't believe that. I believe taxes are the cost of all the government does for you. Of course poor people put in less than they take out--that's the price we pay as a society for our decision to try to bring everyone up because that benefits us all the most. Including, ultimately, middle- and higher-income people, since they too benefit from a relatively healthy, educated, productive working poor.

That's the theory, anyway. You can take issue with individual programs as a way of advancing that theory, but don't complain that your money is being stolen from you and given to poor people. That's just taxes. Taxes take your money. Nobody really likes paying them, so we argue about who's not paying their fair share. In this case, Republicans have clearly decided that the rich are paying more than their fair share, but as SG points out, they refuse to say so.

Anyway, programs benefiting the poor are a very small part of the federal budget. Most government spending goes to debt service, the military, Social Security, and Medicare, the last two of which mainly benefit the middle class.

At 1:15 PM, Antid Oto said…

Antid Oto said…

Incidentally, programs benefiting the poor are in part supposed to help those people rise out of the lowest quintile of earners and ultimately join the ranks of those putting in more than they're getting out. This happened more in the days of higher taxation and more active government than it does now. We have far less social mobility now than we did thirty years ago.

At 3:30 PM, Solomon Grundy said…

Solomon Grundy said…

Very good points, AH.

It bears emphasis that debt service is already a huge part of the national budget, and Bush's debt-inducing tax cuts for the superwealthy are going to be paid for 30 years from now by everyone else, in the form of drastically increased debt service (with compound interest).

So in the long term it's an expensive tax deferment that only benefits the super-wealthy in the short term. Not tax cuts, tax deferments.

I really think libertarians should be APOPLECTIC about Bush's so-called tax cuts. They should be apoplectic for different reasons than I am, but they should still be apoplectic.

At 3:38 PM, LL said…

LL said…

Solomon, actually these tax cuts are introduced by Congress, not the president.

The Earned Income Credit and Welfare are both DIRECT redistribution of wealth. Look it up.

These charts are based on the assumption that the full tax cuts are approved and are made permanent, which in my book is highly unlikely.

According to the Treasury Department, on individual taxes, the share of taxes paid by the bottom 50% (we're not even talking quintiles here, but half of the tax paying population!) will fall from 4.1% to 3.6% in 2005.

I'll keep digging for the data. Just a few nuggets for you to think about.

At 4:33 PM, Solomon Grundy said…

Solomon Grundy said…

Oh, you're right, oops, I didn't read that carefully enough.

Neither tax cut was proposed by the current President Bush as part of his 2001 tax-cut package. Both were added on Capitol Hill

I'll change that in my post.

I don't think those charts are based on the tax cuts being made permanent. They don't go into full effect until 2010, hence the figures being about 2010.

If you accept the Brookings analysis of who benefits from these particular Congressional tax cuts, don't you agree that it's hardly something libertarians should endorse?

At 7:27 PM, LL said…

LL said…

Libertarians are fiscal conservatives (for the most part). This libertarian believes in the free market economy and taxation to support those things delineated in the Constitution that are the federal government's responsibility.

The rest of it falls to the state (via the 10th Amendment). So, basically, since I live in WI and get taxed out the ass, I am VERY resentful to have my federal tax dollars sent to Alabama via the Dept. of Education (which is NOT listd in the Articles as something the feds are supposed to be handling) to improved THEIR schools while I just pay more in state taxes, sales tax, and property to make mine ok.

I don't care if the rich get a tax cut, to be honest, because they invest in the economy via stocks and bonds, charitable contributions, etc, allowing companies to buy the equipment to expand so they can hire more workers, or independent artists to keep making art, and blah, blah, blah. You should know the spiel by now. I really do believe that.

At 2:47 PM, Solomon Grundy said…

Solomon Grundy said…

Hm, OK, well, if you really don't care that these tax cuts are disproportionately benefiting the super-wealthy, then I guess that's cool.

I am very skeptical about the idea that tax cuts for the rich actually pay for themselves, but you and AH already covered that ground in another post.

Although I did read an interesting piece about it recently. Maybe I'll write something short about it...

At 1:01 PM, LL said…

LL said…

Solomon, this is ONE set of tax cuts, out of several over the past few years. And yes, the tax cut favors the super-wealthy, but they also PAY a hugely disproportionate share of our taxes. The combined income of me and hubby put us in the top fifth quintile of those graphs from the earlier post and I can tell you right now, that we aren't living so large and fat that you would be disgusted. The only real luxuries we have are our motorcycles and now they will be sold because of the divorce. I will be dropping down into about the 2nd or 3rd quintile. It's that fast and that easy to affect those graphs and numbers. Keep all that in consideration.

I still haven't had time to read that CBO report, but I'm going to try to get to it this weekend. It sounded interesting.

Post a Comment

<< Home